Most of us are looking to save a little money these days. Cost of living is on the rise across the country, but there may be some areas of the U.S. where budgeting is particularly top of mind.

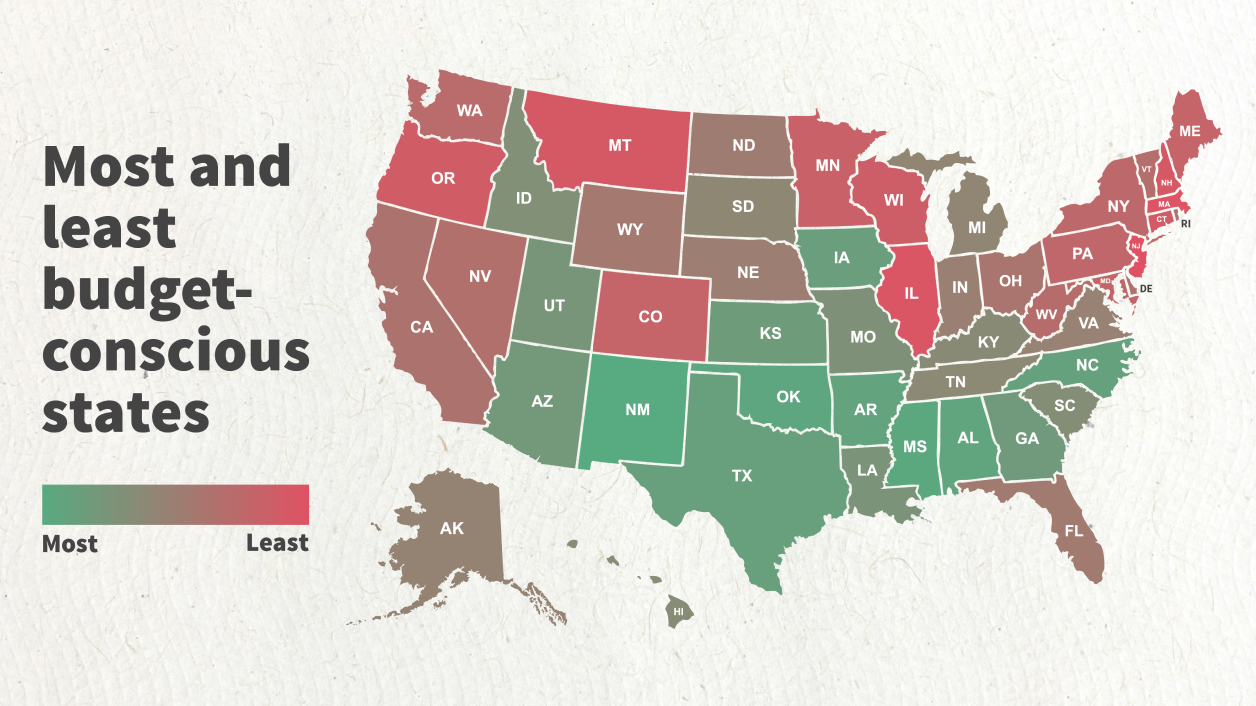

We took a look at search data to see which states are asking Google to help them save money and set a budget. You may think states with higher housing and entertainment costs would be asking for the most help, but this wasn’t necessarily the case. The data tells a surprising story about where budgeting is top of mind for Americans and where it may be less of a concern.

How did we determine the list?

Before we dive into the results, here’s a note on how we pulled the data. We started out by identifying two of the most-searched terms related to saving money–“How to save money” and “How to budget.” We then used Google Trends to find out where these terms were searched the most in the U.S. over the past year. Each state received a combined score based on its average number of searches for these terms, and we ranked the list from highest to lowest.

Dive in to find out where your state stacks up.

Most budget conscious

When we first started our research, we assumed states with major metros and a high cost of living like New York and California may top the list. However, many of those states landed toward the middle of the list, while others with lower cost of living rose to the top.

New Mexico topped our list of states with the most Google searches for popular terms related to saving money and budgeting, followed by Mississippi, Oklahoma, Alabama, and Arkansas to round out the top five.

According to a report by Forbes, all of these states are among the bottom 15 for average annual salary. While the lower salaries appear to be balanced out by lower cost of living, reports show that these states are also experiencing higher poverty rates. Each falls within the top 10 states with the highest rates of poverty in the U.S., which could help explain why money is top of mind for many people in these five states.

The Top 5

- New Mexico

- Mississippi

- Oklahoma

- Alabama

- Arkansas

North Carolina, Texas, Iowa, Kansas, and Georgia rounded out the top 10 most budget-conscious states according to Google search trends. Given the trend we observed in the top five states, we took a look at poverty rates for these states and found that all but one of them were among the 20 states with the highest poverty rates in the U.S. Kansas was the outlier, landing #9 on our list of budget-conscious states and #32 in the ranking for poverty levels.

The outlier here is important. While Google searches reveal some interesting findings, a person’s financial status doesn’t necessarily determine their attitude towards money. Learning to save and spend your money smartly is an important skill to develop, no matter where you are on your financial journey.

The Top 10

- North Carolina

- Texas

- Iowa

- Kansas

- Georgia

Least budget conscious

Following suit with the trends we saw in the top 10, we took a look at the poverty rates for each state that ranked in the bottom 10 of our list. The results were a bit more mixed here, but all states in our bottom 10 did have lower poverty rates relative to those in our top 10.

New Jersey fell to the very bottom of our list of states seeking out budgeting advice from Google. Interestingly, the state also consistently ranks at the bottom of Truth in Accounting's list of the most fiscally sound states in the U.S., which looks at state debt to determine the states with the best and worst fiscal health. Three other states from our bottom 10–Massachusetts, Illinois, and Connecticut–were also very low on the list of fiscally healthy states. Perhaps a bit more research on budgeting and saving could help?

Bottom 10

- Maine

- Minnesota

- Wisconsin

- Oregon

- Connecticut

- New Hampshire

- Montana

- Illinois

- Massachusetts

- New Jersey

Tips to Save Money and Start Your Budget

Seeing where budgeting and saving is top of mind in the U.S. is interesting, but the truth is that a healthy focus on money is important for anyone, anywhere. The fundamentals of smart spending aren’t necessarily intuitive, but they also don’t need to be overly complex.

If you’re looking for a few ideas to keep your spending in check and save for your future, here are some tips to get started:

1. Find out how much you have to spend each month

It sounds simple, but it’s hard to know how much you actually have to spend each month until you dive

into the numbers. Take a look at your average monthly income, subtract your regular expenses (bills,

groceries, and other recurring costs), then take note of the number you have left for discretionary

income.

2. Track your net cash

If you frequently use a credit card, it can be tricky to understand exactly how much of your monthly

income you actually have left to spend throughout the month. One simple way to connect the dots is to

calculate your net cash (the money in your checking account minus the amount you’ve spent on your credit

card).

There are apps that can calculate this for you, or you can set a goal to do this at the beginning or the

end of every week. Find a system that works best for you to stay on top of your spending.

3. Look for opportunities to save

This is easier said than done, but it’s possible there are some areas where you could cut back a bit.

Whether that be trimming down the number of streaming services you subscribe to or calling to try to

negotiate a lower phone bill. Take a look at where your money goes each month to determine where shifts

could be made to ease your financial burden while maintaining your quality of life.

While many essential costs may need to stay put, it’s possible you’ll uncover a few hidden opportunities

to shift from spending to saving–every little bit counts!

Get more tips for financial planning from our website. You can also schedule a free consultation with one of our advisors to learn more about your options to optimize your savings for the future.

- New Mexico

- Mississippi

- Oklahoma

- Alabama

- Arkansas

- North Carolina

- Texas

- Iowa

- Kansas

- Georgia

- Arizona

- District of Columbia

- Utah

- Louisiana

- Missouri

- Idaho

- South Carolina

- Hawaii

- Kentucky

- Tennessee

- South Dakota

- Michigan

- Alaska

- Virginia

- Indiana

- Nebraska

- North Dakota

- Florida

- Wyoming

- Rhode Island

- Ohio

- California

- Delaware

- Nevada

- Vermont

- West Virginia

- Washington

- New York

- Pennsylvania

- Maryland

- Colorado

- Maine

- Minnesota

- Wisconsin

- Oregon

- Connecticut

- New Hampshire

- Montana

- Illinois

- Massachusetts

- New Jersey